| From Thoroughbred News International By Rob Burnet | |

European customers of UK based betting exchange Betfair will be able to make payments using PayPal, a global leader in online payments, following a deal between the two businesses Betfair reported in a statement on Monday. The arrangement will enable Betfair users living in the UK and the other European Union countries to use PayPal to make secure and simple payments to each other. The PayPal service will be fully integrated with the account management section of the Betfair site so its customers will be able to pay in and withdraw funds from their Betfair account in real time. By using PayPal to settle their peer-to-peer transactions, Betfair customers can use a variety of funding sources including credit and debit cards, their existing PayPal balance and, in the UK and Germany, transfers from their bank accounts. Betfair customers will also be able to withdraw winnings directly into their PayPal accounts. Betfair currently handles twice as many credit and debit card activities as any other European website and expects these transaction numbers to increase further thanks to PayPal. Betfair, launched in June 2000, at peak times matches up to 12,000 bets a minute and records 5 million transactions a day. Geoff Iddison, Chief Executive of PayPal UK, said, “PayPal may be best known as the preferred payment method for eBay customers, this is another example of the PayPal system being used by merchants to develop their online business. “Betfair is a popular, highly regarded, regulated and reputable online gaming site. By having PayPal available to Betfair’s customers, PayPal will enable European users to pay and receive funds safely and securely, without sharing any financial information from simply an email address.” PayPal, 100% owned by eBay, is a global online payment company that enables anyone with an e-mail address to make payments online, whether personal or business, within a secure online environment. The company was set up in the US in December 1998 and acquired by eBay in 2002. It reports that it has over 10 million accounts in the UK, more than 100 million accounts worldwide and can be used to make online payments in 55 markets around the world. PayPal prohibits the use of its service for gambling activities by anyone located in the United States. Betfair’s Mark Davies added, “It is a significant step for Betfair to be the first online gambling company approved by PayPal Europe. This will undoubtedly also give us access to a large and growing base of experienced online users.” |

Tuesday, February 28, 2006

Betfair and PayPal agree on online payments deal

Exclusive Look At Google Payments - from Tech Crunch

Posted by Nik Cubrilovic | Discussion: 48 comments

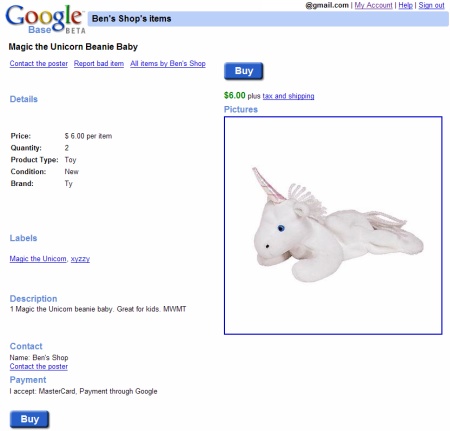

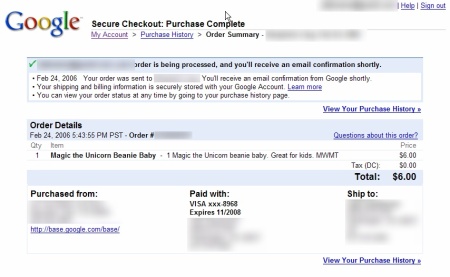

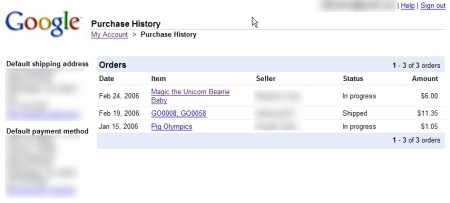

Google announced last week on their blog that they will begin to facilitate payments on Google Base in the near future. The blog post from Google pointed out that Google are already accepting payments on their video service as well as when users purchase software such as Google Earth and that this will be extended further in the near future. The latest updates to Google Base, which we have been able to take a good look at, is to compete directly with eBay by not only allowing sellers to post items to base, but also by facilitating the transaction through Google Payments (see this blog post on purchasing via Base from the Google Base team).

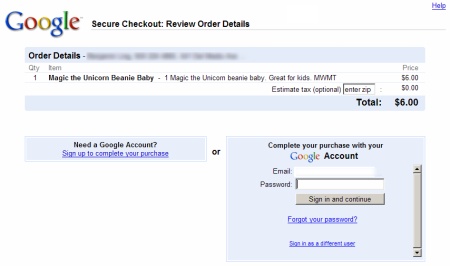

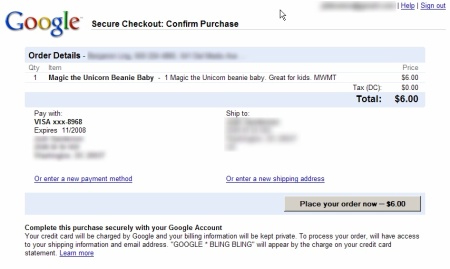

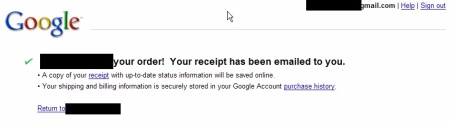

To see some items on Google Base that are accepting payments via Google go to base.google.com and search for either ‘xyzzy‘ for a list of items with payments enabled, or ‘magic unicorn beanie‘ for a particular item. The first thing you see is that a price has been set and you can see that the payment method that is accepted is ‘payment through google’. While ordinary users now won’t get an option to purchase these items, we managed to get some screenshots of how the process will look and work. The next set of screens show the items that had a big ‘buy’ button on them so that the user can purchase them:

The payments site currently redirects to your Google account details but upon public launch, and available on very few select accounts at the moment, the user will have the option to specify or update their credit card details as well as their delivery address details. This means that as a user of Google Payments you won’t need to re-enter this information when making a purchase on Base, or any of the other services from Google that will be taking advantage of the new system. In addition on your account page you will see a history of items that you have purchased and you will be able to check the delivery status of items being delivered, as well as information about the seller of items you have purchased.

Our understanding is that Google is currently testing this service further internally and are in talks to potential sellers on using Google Base and their new payment system to sell items. From the users point of view, it makes purchasing items on any Google property extremely simple. The checkout process is extremely quick and much faster than Paypal’s (page loading times are Google fast) – it also has a much nicer interface making it easier for a user to navigate their way through a checkout and purchase. Overall with Google Base and payments the experience for a user is much nicer than what it is on eBay, a very nice interface and many search features while maintaining the very minimal yet functional interface as expected from Google. I can see that they will be able to maintain this nice interface even as the inventory of items for sale gets much much bigger – their choice of using tags for items as opposed to categories makes it much easier to find items and to fine-tune search results.

What Google does lack at the moment, and something they are working on, is a reputation system so that you can authenticate who the seller is and how trustworthy they are. Building a good reputation system is a very big problem, one that eBay has yet to completely solve so it will be interesting to see what Google will do about this. I don’t know if launching without a reputation system is a good idea, their short-term solution may be to restrict sellers using their payment system to more trusted sources.

What we are seeing here from Google is a direct shot at eBay’s market, as well as other services such as Craigslist - though they have some way to get there. The new payments system means we should see many more services and offerings from Google in the future that cost money, it has made Google Base a lot more interesting and also started up a much needed additional source of revenue.

Monday, February 27, 2006

Zed Staines mobile industry's reputation - The Inquirer

Content provider fined for no helpline

By Tony Dennis: Friday 24 February 2006, 08:45

IT USED to be called Sonera Zed. Now it's known as LaNetro Zed and claims to be the second largest mobile content company in the world with revenues of over €137 million in 2004.Zed UK, however, has just been fined £25,000 for operating without a working helpline for two years.

Zed provides the usual stuff for mobile phone owners – wallpapers and ringtones. The problem is that users could run up a bill after their prepaid credit had run out. So Zed was collecting on past bills.

What this meant was that, for some people, sending the word 'STOP' to Zed's shortcode had no effect. The company continued to send premium rate messages to collect on outstanding debts. Worse still, it was charging interest on monies due.

Zed argued that if people went to its Web site, they could see that it would charge interest. However, many handset owners don't have access to the standard Web – only WAP.

The most shocking admission for a company basing its self in Staines (although its parent is Spanish) was the fact that its helpline hadn't worked for two years. Consequently, in addition to fining the company £25,000, the watchdog (ICSTIS) has told Zed it can't restart until its helpline is fixed.

The most shocking point about this case – which attracted complaints from 60 people who were actually able to find ICSTIS – is the Cavalier attitude of one of the industry's largest players. It beats even mBlox and the Crazy Frog for the 'you-should-have-known-better' award.

The INQ wonders whether this incident will attract the attention of Phil Willis, the chairman of the (UK's) House of Commons Science and Technology Committee. He's already seething that an industry gentleman's agreement not to market handsets to young children is being openly flouted. µ

Mobile Payment - Six years after WAP: from MobileRadicals Blog

Posted on Wednesday 25 January 2006

Ahh, the millennium. Only six years ago but the rate of change in consumer electronics seems to have accelerated significantly in that time. I remember getting my first WAP phone, a Nokia 7110, complete with a Neo-from-the-Matrix button that made a cover shoot down to reveal the keypad. I thought it was so cool, with its scroll wheel for easy browsing on its large and friendly monochrome display. The infamous BT Cellnet (now O2) advert was on at the time, encouraging all to ’surf the BTCellnet’. This of course overwhelmed me with geek excitement and when I was browsing in PC World I even paid out £4 of my hard-earned for ‘WAP User’ magazine. The magazine promised me the world, on my mobile phone. WAP site reviews, hardware shootouts and all the amazing things you could do with WAP. Finally, with trepidation I fired up the browser on my new 7110 and waited. There was a spinning globe on the top-left of the screen. I watched it spin. It kept spinning for around 30 seconds and finally there appeared to be some new stuff coming on my screen. It was a portal, with links to news and sport and other things I could find out in other places much quicker. When I realised this WAP fun was costing me money I soon gave up on it. I am sure this experience was repeated by thousands of others, who gave up and never tried again.

Overselling of WAP and its capabilities was probably one of the worst public relations gaffes from the mobile industry in quite a while. The ‘Surf the BTCellnet’ branding is widely remembered because it promised so much and yet the reality of the WAP experience was slow, cumbersome and expensive. Finally, in 2006, complete solutions for mobile data and browsing are emerging that are actually worth using. With higher speeds available from moving to packet-based data with GPRS, combined with phones that have high resolution colour screens, people are buying games, ringtones and wallpaper in droves, and all of this is enabled with WAP. The UKs mobile networks have now got a lot smarter about branding, and rarely mention the word ‘WAP’, so tainted is it in the public perception. Now they have branded portals like Vodafone Live!, O2 Active and T-mobile t-zones - no confusion there then.

One of the appealing things to me in the early days of WAP was how it was going to change the way we paid for goods and services. No more queuing for cinema tickets, I’d just fire up my WAP browser and buy them online, and they’d be ready for me to collect when I got there. Similar kinds of things were touted with a range of different services but few materialised.

When WAP was The Next Big Thing, consumers were just beginning to get comfortable with using their credit card online to buy goods and services. High profile dot.coms were appearing in every market sector with millions in venture capital funding. Although many users were worried about card fraud, improvements in encryption standards and the recognisable padlock symbol had gone some way to allaying consumer fears. Whilst paying for goods on the internet with credit cards was essentially shoehorning a system designed for the offline world into a browser, it was relatively quick and simple to use. The same, however, cannot be said of using a credit card to make purchases via a mobile phone. Users didn’t trust the device, and with its obviously limited processing power it is easy to see why. Although using a credit card to make purchases works in the home, waving a credit card around in a public place such as a train isn’t a great idea, for obvious reasons.

Using a mobile phone as a replacement for credit/debit cards in the high street is clearly an appealing goal. The mobile phone is so entrenched in our lives in Europe, we take it with us wherever we go, and would nearly always have it when making purchases in a shop. The potential payoff for any company that manages to make such a system work on a large scale is enormous, and with over 80% of people in Europe owning a mobile phone, the sheer numbers of people that could use mobile payment would make it very lucrative.

One of the most appealing tenets of the mobile payment concept is how it could remove the need to carry around a plethora of cards that serve our needs for payment. Many people have 3 or 4 credit cards, perhaps a company fuel card and a raft of store cards. Combing the necessary data from those cards onto one mobile device would be trivial, and could be easily secured with a PIN. Unfortunately, this is unlikely to happen any time soon, and for one major reason: branding. Smartcards that have been available for decades have had the capability to store more than one payment method on them, yet this functionality in the main is unused; why would competing banks want to share their card and hence their space for branding with a competitor? So whilst having more than one payment method per card may happen, it is sure to be only if they are both from the same bank.

It is certainly not the technical abilities of our mobile phones that are preventing the establishment of a pervasive mobile payment solution. With infrared and Bluetooth present on most phones, making a card processing terminal to interface with the device would be no problem. However, there we find another barrier to adoption. APACS (the association of payment clearing services) have recently been struggling to get merchants to upgrade their card processing terminals to invest in Chip’n'Pin enabled units, and its not hard to imagine how well it would go down if all small shops had to buy/rent a new unit that was Bluetooth enabled!

So, it looks like credit cards have the market wrapped up. There is little room in the payments marketplace when there are two extremely large companies who dominate with little reason to innovate or rock the boat. However, payments on the web offer us a ray of hope and perhaps suggest how the next generation of mobile payment will develop.

In the early days of the web, there were a number of startups offering ‘web money’. One of the most well-known, Beenz, gained some acceptance and was ideal for small payments, such as to view a magazine article, where the cost of taking credit cards made them unsuitable. Beenz were effectively money tokens worth 1c each and could be spent at participating web-stores. Known as micropayment, this kind of functionality is still sorely needed on the web. Would we need the barrage of ads and popups if you could easily pay 0.5p to read an article? When thousands of people are paying it adds up to a significant revenue source, and could provide an interesting alternative business model to advertising supported content. Unfortunately, Beenz went the way of many other e-money startups and closed its doors in 2001, leaving behind a trail of unhappy customers when Beenz became worthless.

From the ashes of failed payment systems like Beenz a behemoth has risen in the form of PayPal. Now owned by auction giant eBay, PayPal has changed the way of payments online and has become the only really successful alternative payment method. Of course, looking at this more closely, we can see that it has achieved this by making credit cards easier to use online; vendors don’t need an expensive merchant account with a bank to take occasional payments and consumers can pay easily without having to fumble in their wallet for a credit card. PayPal has brought something more to the table than just making credit cards easier to use on the web; it has enabled person-to-person (p2p) transactions for billions of auctioneers around the globe. This is something that just didn’t exist before eBay and PayPal, now 90% of regular internet users in the UK have an eBay account and everyone has a way to sell their goods to other regular folks just like them.

P2P payments seem to me to be the way mobile commerce startups can establish themselves as a popular payment mechanism alongside the dominant credit card networks. It isn’t difficult to imagine a range of situations where using your phone to pay a friend would be more convenient than cash. Splitting the bill in a cafe 4 ways? Beaming £10 to a friend for taking you to the airport? Combining a p2p payment system with some of the other m-commerce killer apps like parking meters and vending would surely be a winner for consumers and small business. Anyone know a good venture capitalist? ![]()

Google Base now offering payments - from Arstechnica

When a beta of Google Base was unveiled last fall (with the attendant AYBABTU jokes), we observed that Google also had a payment service in the works. Once Google took the wraps off of the Google Video Store, we saw how that payment service worked: using your Google Account, you would be able to save your credit card information so you could easily purchase NBA broadcasts, TV shows, and other content available from the video store.

In a recent update on Google's payment plans, the search giant said that one of its aims with Google Accounts was to make it possible for its users to pay for items online. Google appears ready to take the that step, allowing users to buy and sell on Google Base by using their Google Accounts. A handful of sellers on Google Base will be able to accept payments for items listed on Google Base. According to the Google Base blog, the company plans to start small and gradually increase the number of users and listings available for purchase via a Google Account.

This is good news for those who love Google and don't mind contributing towards the company's goal of indexing everything there is to be indexed. But for a company like eBay—which owns PayPal and 25 percent of Craigslist—this is very bad news indeed. For all of its success—eBay has crushed nearly all the competition in both the online auction and consumer-to-consumer (C2C) payments space—it could be vulnerable if another company with the financial wherewithal and infrastructure to challenge its business model came along.

Hello, Google.

Think of all the eBay Stores and listings with Buy It Now prices. eBay has made the whole buying and selling process quite simple for both buyers and sellers with that feature and its integration of PayPal payments into its listings. However, the company always wants its cut for both selling the item and processing the payments. That adds up. The combination of Google Base and Google Accounts should prove to be a very attractive alternative to high-volume sellers who use eBay as a storefront, especially if Google takes a smaller cut of the transaction than does eBay. Craigslist traffic could also suffer as sellers move their listings to Google Base, especially with Google Base's broader reach than Craiglist's city-specific focus.

eBay-owned PayPal will take a hit, too. Naturally, eBay auction and storefront traffic that migrates to Google Base will result in a drop in PayPal usage. Beyond that, the fact that Google has built the back-office infrastructure necessary to run a C2C payment service should be very troubling to PayPal. Although payments using Google Accounts are currently limited to Google's own products and selected Google Base listings, Google could very well expand the reach of Google Accounts beyond that. Will people be "Googling me the money" instead of "PayPaling" it in another year?

Saturday, February 25, 2006

Google in Payments News

An Update On Google Payments

Google staffers posted an update (below) on their payment-related activity on the Google Blog earlier today. The post pointed to another post on the Google Base Blog about how buyers with Google Accounts will be able to use the credit card they've registered with their Google account to purchase Google Base items.

2/24/2006 12:01:00 PM

Posted by Benjamin Ling, Product Manager & Tom Oliveri, Product Marketing ManagerThere's been a lot of interest and speculation about what Google is doing with payments. We thought we'd give you a quick update on what we've done so far and what we see down the road.

If you take a look at the history of Google's advertising programs and online services, one thing you notice is that online billing and payments have been a core part of our offerings for some time. To run our ad programs, Google receives payments every day from advertisers, and then pays out a portion of those funds to advertising partners. Over the past four years, Google has billed advertisers in 65 countries more than $11.2 billion in 48 currencies, and made payments to advertising partners of more than $3.9 billion. When one of our consumer services requires payment to us, we've also provided users a purchase option.

As the number of Google services has increased, we've continued to build on our core payment features and migrate to a standard process for people to buy our services with a Google Account. Examples of this migration include enabling users to buy Google Video content, Google Earth licenses, and Google Store items with their Google Accounts. We also just began offering similar functionality on Google Base.

Looking ahead, we want to continue building payment services that meet the needs of Google users and advertisers. We expect to add payment functionality to Google services where our users need a way to buy online. For us, it's all about bringing our users a better online experience whether they're searching or buying."

Friday, February 24, 2006

Skype Using GlobalCollect for Alternative Payments

-from Payments News

GlobalCollect has announced it has been selected by Skype to process payments for its premium offerings. For Skype, GlobalCollect will process local bank transfer payments in local currencies worldwide, including real-time online bank transfers in countries where this payment method is available.

GlobalCollect has announced it has been selected by Skype to process payments for its premium offerings. For Skype, GlobalCollect will process local bank transfer payments in local currencies worldwide, including real-time online bank transfers in countries where this payment method is available.

Alternative payment methods such as local bank transfers offer various major advantages for online merchants as well as for their customers. With an almost non-existent percentage of fraudulent transactions, bank transfer payments provide merchants with more security than credit cards. For online shoppers, local bank transfers in local currencies are very customer friendly. The amount to be paid is calculated in a local currency and no credit card information needs to be provided online. Alternative payment methods are a way for merchants to considerably increase their customer base with shoppers who prefer not to use their credit card online, and in countries where credit cards penetration is low, such as in several Asian countries (China, Japan) and many European countries (Germany, Spain, Sweden and Italy).Michael Jackson, head of paid services at Skype says: "We identified GlobalCollect as a leading payment service provider for non-credit card payments. The possibility to accept local bank transfers in over 50 countries through one single technical and administrative interface is an efficient way to ensure our customers will be able to pay with a familiar payment method, in their currency."

Jan Manten, CEO of GlobalCollect adds: "We are very pleased to welcome Skype as one of our customers, and we are confident that the addition of local payment methods will further strengthen the worldwide success of Skype."

Thursday, February 23, 2006

More on the Motorola M Wallet - from Mobile Weblog

Hey Moto, Lend Me $5...

Filed in archive New Applications by scott

Tired of standing in the rain waiting for your turn at the cash machine? Moto to the rescue.

Motorola has announced development of a new m-wallet solution called, well, M-Wallet. The new mobile wallet can carry funds or receive uploaded "coupons" or value from merchants apparently. And it is platform agnostic:

"Motorola’s M-Wallet is network and device agnostic and works with GSM, CDMA, or iDEN® technologies, and is compatible with Symbian, PocketPC, Palm, J2ME, Brew and SimTk. The solution consists of two components: first, M-Wallet is the application that consumers and merchants download from the Internet; second, the Wallet Service Center allows the operator to manage administration, registration, issuance of credit and debit cards, coupons, archiving, customer profiles and maintenance. It ensures end-to-end security throughout the platform and all of a user’s banking and credit information is stored with their financial institution."

Credit due to Payment News

I've been sloppy in adding: "Copyright © Glenbrook Partners LLC, 2002-2006." to each of those posts... but just so you know:

Feedblitz is how it gets delivered to me

Payments News is the newsletter, and

Glenbrook Partners is the payments specialist company that produces the newsletter.

.. and this is the citations policy that I'm probably running afoul of.

Skype Offers Click&Buy as Online Payment Option

New infoDev Report on m-Commerce - Payments News

http://www.infodev.org/files/3014_file_infoDev.Report_m_Commerce_January.2006.pdf

Tuesday, February 21, 2006

Momentum Building Towards a "Cashless" Society

While futurists have spun predictions of a "cashless" society since the middle of the last century, momentum is gathering that may turn this vision into reality in as little as 10 years. New research from TowerGroup finds that a combination of market-ready and emerging technologies is aligning to drive a majority of consumer payment transactions from cash toward other payments "form factors" - including the Internet, mobile and contactless payments.

"By 2015, a substantial share of consumer payments globally will have moved from cash to other payment mechanisms," said Theodore Iacobuzio, managing director in TowerGroup's Executive Research Office and content lead on the European Banking & Payments practice at TowerGroup. "Many of these new form factors are already being tested in broad consumer settings in countries around the globe - from contactless payment terminals and fingerprint recognition payments, to mobile and micropayment roll-outs."

Highlights of the research include:

* Over time, TowerGroup believes payments will move increasingly toward a "pay-as-you-go" model, where consumers buy what they want wherever they are. But while payments will be made increasingly through clicks and texts rather than cash or even traditional plastic, the majority will still be fueled by traditional bank relationships and run through established payments networks and infrastructure.

* TowerGroup expects the total market for micropayments in the United States to reach US$11.5 billion by 2009, with almost US$5 billion of that amount transacted via mobile phones. The global mobile commerce market is expected to become a major industry with revenues of US$50 billion to US$75 billion by 2009 - with global micropayments generating about US$40 billion in revenue.

* As payment mechanisms shift away from cash and traditional card forms, stronger authentication methods will become increasingly critical - particularly to move beyond micropayments in the mobile realm to allow the purchase of high-value items. TowerGroup expects to see aggressive movement in the financial application of biometrics authentication technology over the next 10 years, fueled in part by government adoption.

* TowerGroup notes that financial institutions dismissing evolving payments models as quirky or meaningless to their current business strategies risk being supplanted by more nimble and far-sighted competitors. They must also consider the impact of non-traditional payments players, such as telecommunications companies looking to grow their share of the nascent mobile payments space.

"Ultimately, control of the payments network itself will be more important than changes in the form factor of payments," said Iacobuzio. "While certain non-traditional players may make headway in taking share of new payments mechanisms, TowerGroup believes that the payments network as a whole will remain firmly in the grip of financial services institutions - though the definition of what constitutes such an institution is currently in flux. The nature of payments form factors should ultimately be irrelevant to financial institutions, as long as they are willing to engage in innovative partnerships to keep up with both technology and consumer desires. If they ignore the issue, however, they could lose the ball."

EBay safe payments policy

Safe Payments Criteria

From time to time, as new payment services arise, eBay will evaluate them to determine whether they may present trust and safety concerns and are appropriate for the marketplace. eBay will consider the following factors, among others, in making its determination:

* Whether the payment model offers substantial financial, privacy and anti-fraud protection for buyers and sellers

* Whether the payment model raises the potential for confusion among eBay users, or involves incentives that may present fraud concerns

* Whether the payment model involves precious metals, or other non-cash (points, miles, minutes, coupons, discounts) as consideration

* Whether the payment service has a substantial historical track record of providing safe and reliable financial and/or banking related services (new services without such a track record generally cannot be promoted on eBay)

* The identity, background and other business interests of the payment service sponsor

* The licence/regulatory status of the payment provider in the countries where it provides payment services

Offline payment methods generally do not offer the same level of protection or convenience as online payments. Nonetheless, they may be appropriate for certain types of transactions and sellers may use listings to offer acceptance of most valid financial instruments, including personal cheques, bank cheques, money orders or COD.

Policy

Permitted on eBay.com.au: Sellers may offer to accept PayPal, credit cards including Mastercard/Visa /Amex/Discover, debit cards, bank payments as well as bank-to-bank transfers. Sellers may accept COD (cash on delivery) or cash for in person transactions. Sellers may offer to accept personal cheques, money orders, bank cheques and other negotiable instruments.

Not permitted on eBay.com.au: Sellers may not solicit buyers to mail cash. Sellers may not ask buyers to send cash through instant cash transfer services (non-bank, point-to-point cash transfers) such as Western Union or Moneygram. Finally, sellers may not request payment through online payment methods which fail to comply with the safe payments criteria, above.

Violations of this policy may result in a range of actions including:

* Listing cancellation

* Forfeit of eBay fees on cancelled listings

* Limits on account privileges

* Loss of PowerSeller status

* Account suspension

This policy does not affect any payment method commonly offered on eBay today. However, there are some sellers who have listings offering to accept cash and Western Union instant cash transfer, and a few who offer other payment methods that are not permitted under this policy. To avoid disruption of these sellers’ business during the holiday shopping season, eBay will delay enforcement of this policy against existing payment methods until 15 January, 2006.

http://pages.ebay.com.au/help/policies/safe-payments-policy.html

Monday, February 20, 2006

First E-Bay user to accept LUUP!

http://cgi.ebay.de/ws/eBayISAPI.dll?ViewItem&item=8757683018

The Telegraph on content at 3GSM

In Barcelona last week (the event has outgrown its original home of Cannes), more than 50,000 3GSM delegates and 2,000 journalists sat through endless seminars, keynote presentations and glitzy product launches from the largest players in the industry.

This year, there was a single word that cropped up in every conference hall: content.

For years now, the mobile industry has been promising whizzy new media services that will transform our humble handsets into entertainment centres. Music downloads, high quality games and live TV are just a few of the services now available on mobile phones.

And the industry needs its customers to start buying these content services. Like the fixed-line telecoms industry, mobile operators are suffering as the price of voice calls falls by about 10 per cent per year.

To compensate, operators are hoping that mobile customers will download other products and boost their data revenues.

Virgin Mobile used 3GSM to unveil a new TV mobile, available this summer in the UK. Vodafone announced a partnership with Google and T-Mobile showed off a new HSDPA device which promises an internet connection faster than many home broadband services.

But fundamental questions remain - do consumers want to pay for media content on their mobile phone and if they do, will the mobile operators get to see the financial benefit?

Arun Sarin, the beleaguered chief executive of Vodafone, said on Tuesday that his company had no intention of becoming a content owner.

"We are a packaging company for content," he said. "We have no intention of becoming a vertically integrated content player. That would require a completely different skill set."

Sarin's counterpart at T-Mobile, Rene Obermann, echoed these comments later that same morning.

For Sarin and Obermann, the value of all this content is in the revenues accrued from the data downloads to the handset.

Unlike Vodafone, which seems to see itself as the shop door to mobile content, T-Mobile has taken the view that its customers should be free to look at whatever content they want without unnecessary direction from the operator.

The group's Web & Walk open internet system allows mobile customers to browse the web on their mobiles in exactly the same way they would use their home PC.

An executive at T-Mobile said: "The walled garden approach to content has failed. Operators will all have to allow customers to freely browse the internet without limiting their options."

But some analysts believe that as voice calling becomes increasingly commoditised, failure to secure content revenues will mean that mobile operators become little more than utility type companies carrying data in their pipes, rather than, for example, gas or water.

New data from M:Metrics, the mobile market research company, shows that advances in technology have led to increases in data usage.

However, despite the adoption of next-generation or 3G networks, which allow higher download speeds, relatively few consumers use their handsets for anything other than making phone calls or sending text (SMS) messages.

According to M:Metrics's data for December, only 7.1 per cent of UK mobile customers used their handsets for purchasing a ring tone in the month. Just 4.1 per cent bought a game using their mobile and only 6.3 per cent used it to send or receive a personal email.

However, the proportion of customers who access content is higher for those on 3G networks than on 2G, indicating that advances in technology do drive content spending to a small extent.

But that does not hide the fact that content is generally still too difficult to access, expensive and of poor quality. Furthermore, no one in the mobile industry has any real idea about whether consumers actually want to access much of this new content or how much they are prepared to pay.

A recent research note from Gartner advised mobile operators to "lower your revenue share expectations for data services as its clear consumers will continue to use voice services more heavily".

Obermann said: "Inevitably, there is a transition between today's world and tomorrow's. Just as the time it takes to deliver the new services and service is underestimated, so is their impact when they are delivered. Mobile broadband will change the way we live, work and communicate even more than mobile voice has done."

There are a few rays of light in the darkness. Wang Jianzhou, the chief executive of China Mobile, told a crowded hall at 3GSM that a popular pop song in the world's most populace country had been downloaded 15m times in a single month.

New HSDPA network technology will bring fast broadband internet speeds to mobile. T-Mobile believes that mobile broadband will remove the need for consumers to pay for a fixed-line broadband connection.

And the global community of 2bn mobile phone users represents an unprecedented new market for advertisers.

One senior industry figure said: "Look at Google and its advertising success story. Mobile operators, if they can capture even a small slice of mobile advertising expenditure, will be onto a winner."

But for now, Western mobile bosses appear to be more concerned about their more immediate prospects.

Ben Wood, the mobile analyst at Gartner said: "Chief executives are more concerned about keeping their jobs and stabilising margins. Its tough out there."

PayPal phishing exposure

A PayPal Phish Story?

John Darling reports for the Medford, OR Mail Tribune on one woman's recent experience with having her checking account nearly emptied after someone apparently took over her PayPal account. She was "made whole" through the efforts of PayPal and her bank - but the experience was difficult nonetheless.

Friday, February 17, 2006

US Warms to Mobile Commerce - Red Herring

February 14, 2006

After a decade of false starts, the era of the electronic wallet may be finally dawning in the

While consumers in

That will change beginning in 2007, said Dan Schatt, the senior analyst at Boston-based Celent who wrote the report. Celent predicts that the mobile commerce market in 2006 will be worth $24 billion, with

In 2008, that figure is expected to more than double to $55 billion. And with four out of five Americans subscribing to mobile service by then, the

Driving the trend is the growing number of so-called 3G handsets, which carry more data. The number of 3G phones in the

Exploit or Miss

The rise of mobile commerce represents a large opportunity for banks and carriers to either exploit or miss, Mr. Schatt said. If banks cede ground to upstarts like Google on mobile transactions, the forfeited profits could be huge.

More than $1 trillion of commerce is completed each year with a “ticket” size of $10 or less, according to Celent. The shifting landscape poses a similar challenge for carriers. Cooperation between banks and carriers is the solution, Mr. Schatt said.

“Anyone who bets against bandwidth is going to lose,” he said.

Startups will have a chance to profit as well. Companies that help banks and carriers stave off irrelevancy at the hands of Google or Paypal/Skype will find a ready market, said Mr. Schatt.

“There’s a place for technology that can insert itself in the ecosystem and help facilitate mobile commerce,” Mr. Schatt said.

Celent’s prediction that commerce over the handset is gaining traction in the

“This year we expect several implementations from major carriers,” said Matt Hall, Vesta’s vice president of business development.

Tuesday, February 14, 2006

PayPal pushes past 100 million member milestone

PayPal began offering its service in 1999, ending that year with 12,000 accounts and $235,000 in total payment volume. In 2005, PayPal says it processed more than $27bn in total payment volume and exceeded $1 billion in revenue.

The company was acquired by online auction house eBay in July 2002 in a $1.5 billion all-stock deal.

Jeff Jordan, president of PayPal, says: "We've spent the last seven years building a very safe, easy and convenient way to pay online. Our customers prefer to use PayPal because privacy is built right into the service - they can shop online without sharing their financial information with sellers."

PayPal has localised services in 14 countries and supports payments in seven currencies - US dollars, Canadian dollars, Australian dollars, euros, pounds sterling, Japanese yen and Chinese yuan.

Friday, February 10, 2006

TextPayMe in Wired

By Rachel Metz ![]() |

| ![]() Also by this reporter

Also by this reporter

02:00 AM Feb, 10, 2006

When a group of people dine out together, someone always lacks cash. They forgot to go to the ATM, but they'll pay you back ASAP. Right.

Funny, though, how people rarely forget their cell phones. Philip Yuen put these two observations together and came up with TextPayMe to let people send money using text messaging.

TextPayMe seems like a logical second act for PayPal, but Yuen sees the services as complimentary.

"We just want to take over the world in all face-to-face transactions," he said.

TextPayMe doesn't have much competition in the United States so far, but PayPal may be hot on its heels. Ironically, PayPal began as a service for beaming money between PDAs. While people can now use PayPal through web-enabled cell phones, the company doesn't have an SMS function.

But a recent Craigslist job posting for a business manager for "PayPal Mobile," described as "a dynamic, young 'start-up' business unit within PayPal dedicated to bringing value-added mobile payment services to consumers and merchants," has launched rumors that such an offering may be forthcoming.

"We haven't made any announcements in the mobile payments world," the PayPal spokesperson said.

Yuen, a former Microsoft program manager, teamed up with his Lockheed systems analyst brother, Gerald, and another Microsoft employee, CJ Huang, to get TextPayMe rolling. The trio secured funding from startup seed company Y Combinator and launched the TextPayMe beta in mid-December.

TextPayMe works much like PayPal -- users create an online account and link it to a credit card or bank account. They can use SMS to send up to $500 a month. The service is now free, but the company might eventually charge fees for certain transactions, Yuen said. Beta adopters might have permanent free use, he said.

Combining text messaging and payment sounds like a pretty good idea when you consider 203 million people in the United States use cell phones, according to the CTIA, and 96 million people use PayPal.

Russ Jones, a payment industry consultant with Glenbrook Partners, said the move toward using cell phones for payment is inevitable.

He noticed, however, that TextPayMe's user agreement explicitly gives the company permission to pull users' credit report. That might scare some people away. That's a deterrent TextPayMe doesn't need with PayPal potentially nipping at its heels. So far, about 900 people are signed up and about a third have completed transactions, he said.

Mark Toews, a technical recruiter in Seattle, said he signed up for TextPayMe about a month ago, but only used it once because his friends won't sign up. They're not willing to give up bank information to a new company. Toews hopes TextPayMe will become more popular.

"I think it's a great service," he said, "it just needs more time to mature and more people to get signed up with it before it will really blossom."

Thursday, February 09, 2006

New mobile payment provider: PayWi

At the Demo '06 conference here on Wednesday, two companies presented services that they positioned as ways to handle secure payments while on the go without physical credit cards, cash or checks.

The first, Portland, Ore.-based PayWi, demonstrated how its service can let people pay for just about anything with their mobile phones.

The idea, explained PayWi CEO Dave Barram, is that consumers would sign up online, provide their personal and payment information, and then be able to use their account from anywhere, at any time, to settle a bill.

For example, Barram said, consumers could pay for an item at a retail store, pay for parking, send money to a friend or handle any number of other transactions. To do so, they would log in via their mobile phone, enter the merchant's information, how much the bill is, who is supposed to get the money and a five-digit PIN. Then the money would automatically be transferred to the intended recipient.

Another company presenting here, Pay By Touch also asserts that physical credit cards are obsolete.

Its service, which it said is deployed at two of the five largest American grocery chains, lets consumers pay for purchases by simply touching a finger scanner and entering a PIN.

Like with PayWi, the idea is that people sign up ahead of time and provide the necessary personal and financial information.

Then, they use a finger scanner at home or work to submit their fingerprint to the system.

This also works with Pay By Touch Online, the company's approach to obviating the sometimes-frustrating requirement of remembering a user ID and password for every online service people use. Instead, they attach their finger scanner to their computers and when they try to enter a site that employs the technology, they need only to scan their finger and enter a single PIN and the software authenticates them.

Thus, assuming a lot of sites partnered with Pay By Touch, consumers could expect to have to remember just a single PIN and then let their finger do the proverbial walking when it comes to logging in to the many sites they frequently use.

The problem with both these services is that they depend on heavy-duty implementation by brick-and-mortar and online retailers and merchants in order to be useful. And while there's certainly a motivation for merchants to get involved, a service as widely adopted as PayPal has not been able to convince many real-world or online retailers to accept it as a payment method.

Motorola M-wallet - from Payments News

A Motorola press release this morning contains more details on the M-Wallet:

Motorola Helps Subscribers Leave Their Wallets at HomeNew solution makes it simple to pay bills, conduct money transfers and complete point-of-sale purchases with your mobile phone

ARLINGTON HEIGHTS, Ill.- 08 Feb. 2006 - Paying bills on time, transferring money to a friend in the same or different country, or making a purchase at a retail store just got easier with Motorola’s (NYSE: MOT) M-Wallet Solution, announced today. Motorola’s M-Wallet features an easy-to-use mobile interface that gives the consumer quick access to the financial world virtually anywhere, anytime, in a secure and convenient way—eliminating the need to carry a credit or debit card in your wallet.

Motorola’s M-Wallet also addresses the needs of companies that wish to innovatively market their goods and services. For example, merchants can issue virtual loyalty or gift cards directly to their customer’s mobile phone. These cards can be redeemed via a mobile phone or can allow customers to conduct secure point-of-sale transactions, collect loyalty point, and obtain store receipts at existing retail merchant locations. M-Wallet users must opt-in to receive coupons or other promotional services, allowing them to choose preferred merchants who participate in the program and thereby reducing spam.

“Mobile phones are no longer just about conducting conversations, they are now emerging as a center of people’s lives for every day transactions,” said Navin Mehta, Motorola’s vice president of Applications Management. “With M-Wallet, Motorola continues to offer industry leading applications that not only bring convenience and flexibility to subscribers but help operators differentiate and advance their portfolios to increase mobile data usage.”

This enhanced value is provided in several ways. For example, when the M- Wallet solution is deployed within Motorola’s scalable Global Applications Management Architecture (GAMA) service delivery and content management architecture, operators can more proactively manage and extend the merchant value chain. Because the merchant community and end users alike can securely and consistently access the network to conduct safe transactions, the infrastructure provides operators with the rich retail ecosystem necessary for delivering and promoting new applications - a key to growing average revenue per user over time and enhancing end-user experiences. In addition, operators also can take advantage of Motorola’s application hosting services to minimize deployment time and more rapidly bring the benefits of this solution to end users.

Motorola’s M-Wallet is network and device agnostic and works with GSM, CDMA, or iDEN® technologies, and is compatible with Symbian, PocketPC, Palm, J2ME, Brew and SimTk. The solution consists of two components: first, M-Wallet is the application that consumers and merchants download from the Internet; second, the Wallet Service Center allows the operator to manage administration, registration, issuance of credit and debit cards, coupons, archiving, customer profiles and maintenance. It ensures end-to-end security throughout the platform and all of a user’s banking and credit information is stored with their financial institution.

Wednesday, February 08, 2006

Online bill paying - Feedblitz

The latest issue of the FDIC's Supervisory Insights newsletter contains the article "Online Delivery of Banking Services: Making Consumers Feel Secure" by Richard D. Lee, Senior Technology Specialist at the FDIC. This article reviews key findings of an FDIC study that evaluates a variety of identity authentication technologies. The article also focuses on interagency guidance requiring insured financial institutions and service providers to address the protection of sensitive customer data and assets as part of the development of Internet banking products and services.

As insured financial institutions begin to assess their risks as outlined in the interagency authentication guidance, they should consider each type of transaction consumers can initiate online. The types of transactions may include the following:

- Access to the bank's website for new product offerings or CD rates

- Access to an individual deposit account

- Access to a deposit account and an automatic bill-paying option

- Ability to transfer money from one account to a related account

- Ability to transfer money to a third party

The above transactions are ranked by level of risk (beginning with the lowest level) they represent to the institution and the customer. The first transaction allows access only to general bank information; customer information or bank accounts cannot be accessed. This transaction is considered relatively low risk and would not require strong access controls.

However, the last transaction, which allows an online customer to wire or transfer money to another party, should require more than a password to initiate. In this case the bank should require the customer to supply authentication credentials such as a one-time password token. This layered approach to authentication matches low-risk transactions with less robust solutions and higher-risk transactions with stronger solutions. Risks falling in the middle would be addressed according to the potential for compromise of sensitive data or assets.

Insured financial institutions must comply with the interagency authentication guidance by December 31, 2006. To do so, they should begin performing risk assessments as soon as possible and, based on the results of these assessments, implement stronger authentication strategies by year-end 2006.

Electronic wallets reduce retailer problems - Feedblitz

Let Your Fingers Do The Paying

Matthew Boyle reports for Fortune on biometric-based payments and recent research by Sanford Bernstein analyst Emme Kozloff into their potential benefits for major retailers like Wal-Mart, Target, and Costco.

The report, by Sanford Bernstein analyst Emme Kozloff, found that the use of so-called "electronic wallets" reduces the potential for fraud and identity theft, speeds up the checkout process, and most importantly, lowers transaction processing fees for retailers, improving their bottom line. A 20% reduction in processing costs at big-box discounters like Wal-Mart over the next several years could result in a 3% to 4% increase in earnings per share by 2009, the report estimated. "We believe both Wal-Mart (Research) and Costco (Research) are looking at it closely," Kozloff wrote. (Both companies declined to comment.)

Zopa Blog an interesting read - from Feedblitz

Zopa - A Finance 2.0 Company

One of the cool things about Zopa is their Zopa blog where they talk regularly about the stuff they're doing in revolutionizing the consumer finance space. We first wrote about Zopa last August.

One of the cool things about Zopa is their Zopa blog where they talk regularly about the stuff they're doing in revolutionizing the consumer finance space. We first wrote about Zopa last August.

Let's declare a new category of companies - call them Finance 2.0 companies (similar to those Web 2.0 companies) - that includes folks like Zopa who are purposely conversational with their market and customers.

The latest Zopa blog post, New Kid On The Block, welcomes Prosper.com as a competitor in this space. Sorta reminds me of that Apple ad way back when IBM launched its first PC. We'll have to see whether Prosper.com joins the Finance 2.0 club - or not. No signs of a company blog from them yet.

Separately, Umair Haque blogs on his BubbleGeneration blog about Prosper.com and points out that Benchmark Capital has invested in both companies. He also discusses the potential size of this market opportunity and suggests the last similar innovation in the consumer financial services space was PayPal.

Technorati Tags: Zopa, Prosper.com

Tuesday, February 07, 2006

Mobile ATM in Davos - Sunday Times Jan 29 06

ALASTAIR LUKIES has just had a thrilling introduction to the World Economic Forum in Davos. Attending the Swiss summit as a “technology pioneer”, Lukies has spent the past week rubbing shoulders with international statesmen and the heads of some of the world’s biggest companies — along the way securing important deals for his yet-to-be-launched banking and payments business, Mobile ATM.

Lukies’s new partners include one of the best-known brands in Britain, and one of the most powerful companies on the internet. “It has been fantastic,” he said, “I’m absolutely humbled by it. I’ve had a secretary of state who’s been unbelievably supportive, taking time out to introduce me to lots of people.

“The technology entrepreneurs here are actually at the top of the pile for once, rather than at the bottom. They’re seen by everyone as the next wave of thinkers.”

Mobile ATM may be an unknown name, but previous technology pioneers recognised by the WEF have included Google and Skype. The latter would have been similarly unfamiliar to most Britons this time last year. A few months later it was bought by Ebay in a deal potentially worth $4 billion (£2.2 billion).

Mobile ATM, a joint venture between the Link cash-machine network and Morse, the quoted technology company, is also set to become much better known.

In a few weeks’ time, Mobile ATM will launch a service that will allow most mobile-phone users to have “on demand” access to their bank-account details. Additionally, the two-thirds of mobile users who “pay as you go” will be able to top up without having to buy vouchers from a newsagent or using an electronic top-up machine.

Users will need to register with Mobile ATM to validate the connection between their phone number and bank account. They will then be able to check their balance by keying in a five-digit Pin after establishing a mobile-data connection to the Link network.

Lukies, 32, believes the convenience of Mobile ATM’s service means it will capture a large slice of the UK’s £4 billion-a-year mobile top-up business. “You won’t have to go and find a newsagent that’s open, you will be able to top up your phone, or your daughter’s phone, or your brother’s, while sitting on your couch.”

Lukies and co-founder Steve Atkinson have devised a system to work with all mobile operators and all 37 banks that use Link. This desire for comprehensiveness has led to some delay: Mobile ATM originally planned to launch last year.

HSBC and First Direct will be among the four banks participating when the service goes live in March. And mobile top-ups are just the start. Lukies hopes other payments could also move on to the secure system — for example, London’s congestion charge, credits for the Tube’s Oyster card, and the purchase of lottery tickets.

Mobile ATM believes it can generate highly prized data traffic for the mobile-network operators, and reduce costs for them and for the banks. Although top-up calls will be free, balance inquiries will attract a flat rate-charge.

Every month the Link deals with 150m balance inquiries via its cash machines. Many millions more are handled by bank call centres. Substantial savings could be made if some of this burden shifted to the Mobile ATM service.

Lukies said his service would also be able to cut the cost of top-ups to the mobile companies by as much as half. Distributing vouchers is costly, and even though electronic top-up is cheaper and more efficient, Mobile ATM plans to cut the cost still further, charging a commission of about 4%.

While this is an interesting use of mobile technology, it would not have caught the attention of the WEF at Davos were it not for its potential use in the developing world. In Africa and Latin America, mobile phones are already far more ubiquitous than bank branches. The WEF believes Mobile ATM’s system could be used to make financial services much more widely available in the developing world without having to invest in expensive and unnecessary branch infrastructure.

Mobile ATM is working with Sun Microsystems to roll out its service across three continents.

“This is two big industries getting together and putting the consumer first,” said Lukies — the sort of upbeat message that goes down well at DavosLUUP on Mobile Phone Development blog

http://mobilephonedevelopment.com/page/2/

Selling Your Software

January 25th, 2006 If you sell your mobile software direct to consumers, check out Sharewire who offer payment by premium SMS, interactive telephone voice response, credit card, Paypal and now, LUUP.

If you sell your mobile software direct to consumers, check out Sharewire who offer payment by premium SMS, interactive telephone voice response, credit card, Paypal and now, LUUP.

Sharewire describe LUUP as follows…

"We are please to announce the launch of an exciting new payment method for your customers which offers the same payouts as Credit cards or Paypal. LUUP is an e-wallet, a bit like PayPal, but with some important differences;

- Customers can pay by SMS as well as online. To pay by SMS, they send the same codes as before to the same number but instead of billing their phone bill, we bill their LUUP account. Online, customers simply enter their mobile number and PIN code. Sharewire will only support the pay by SMS method.

- LUUP is open to anyone over 14, unlike Paypal and credit cards.

- LUUP is more secure. Like Paypal, customers don’t need to give their card details, but because LUUP uses the mobile phone it is less open to fraud

However, customers must register for a LUUP account before they can use it. Therefore, for products up to EUR 5, we will offer the first product a customer purchases for EUR 1 to encourage registration. This enormous discount is paid for by LUUP and will not affect your payout. In other words: you can sell your products for 1 Euro and still get paid the normal 60% of the regular price! You do not have to do anything to apply; at the end of next week, our payment screens will include LUUP as a payment method. However, you can decide you do not want to offer your products for 1 Euro (and get paid the normal rate).

We encourage you to take full advantage of this opportunity and let your customers know they can get your content for 1 Euro.

LUUP is available for customers from the UK, Germany and Norway only."

At the same time, Sharewire have introduced a ‘free’ pricing model where people can download your application for the normal cost of an SMS. You, as a developer, just pay for an SMS bundle to deliver the application. This is great for trial versions or free applications that provide a service that’s paid for another way.

As always, this isn’t an advert and I get nothing from this. Sharewire is just a service I have used in the past and recommend. In fact, I was one of their first customers.

Richard Kershaw blogs about LUUP

Bubble 2.0: Invest like it's 1999

Mobile startups are being hyped to high heaven.

The excellent MobileCrunch is filled with great ideas paired with half-baked innovative business models that will never make enough money to cover my monthly mobile bill.

Understandly, sceptics cry Bubble 2.0, although one blogger has already pointed out that it’s only a bubble if the price goes up.

I say: who in their right mind squares up to Google with their own take on AdWords/AdSense mobile? Google are cagey about mobile text ads, but a launch is inevitable.

But there’s the odd gem that - gasp! - appears to boast a workable business model alongside the Aeron chairs, excessive VC funding and fußball table.

Luup lets users send and receive cash with a simple system of text messages. Most Luup services are free to use - presumably until SMS costs and fraud rocket.

Luup are presenting at the 6 February Mobile Monday meetup on mobile payments, alongside Reporo and Mi-Pay. See you there.

Monday, February 06, 2006

AuctionBytes Payment Survey

The results are in from AuctionBytes' online-payment survey of readers conducted in January. While the survey shows PayPal is used by an overwhelming majority of respondents (over 94%), a look at the comments fields reveals that some sellers do have areas of concerns with the service, including the following:

- PayPal fees

- Levels of customer service at PayPal

- Concern over a lack of competition, with some mentions of Google as a possible alternative

- Security and spoof emails

- Dissatisfaction with PayPal's dispute resolution

- PayPal accessibility issues

- A need for a way to facilitate international payments

It's important to note that some respondents expressed satisfaction with PayPal fees and service. A few wrote comments along the lines of this comment:

"Overall, the (PayPal) site works fine most of the time. But those times when it doesn't - it is a frustrating mess."

PayPal was the number one form of payment accepted in online auctions, storefronts and retail websites by respondents, followed closely by postal money orders and money orders, which were followed by checks. The reason for PayPal's success may be answered in a subsequent survey question: only 26 percent of respondents have a credit card merchant account, 74 percent do not. (PayPal allows individuals and businesses to accept credit cards without having to have a credit card merchant account.)

Slightly more than half of the respondents had accepted BidPay in their online listings before it ceased operations on December 31, 2005, and 61 percent said the closing would not affect their sales.

Respondents were asked, on average, what percentage of their online transactions do a list of payment services comprise, for a total of 100 percent. The average response indicated that PayPal comprised 79 percent of all transaction payments, credit cards comprised 23 percent, and checks comprised 12 percent.

With regard to the level of satisfaction with the current choice of payment services, 185 respondents (39%) said they were satisfied with the number of payment services available and 236 respondents (almost 50%) said that a greater choice of payment services was needed.

AuctionBytes invited its newsletter subscribers to take the survey in January. Respondents reported selling more items in categories that are considered "collectibles" as opposed to "practicals." Thirty-six percent of respondents said they sell between 1 - 10 items/week on average, and 23 percent sell between 11 - 25 items/week; 18 percent sell between 26 - 50.

There was a diverse selection of secondary online payment methods, including some services that we were not familiar with. In the "best of the rest" category, MoneyBookers, Ikobo, ProPay, Nochex and Ikobo received the highest number of votes (all less than 3%). We would like to hear more about these and other payment services. Share your experiences in this discussion forum thread that we've started on the AuctionBytes site: http://digbig.com/4gehr

The raw survey results can be found here: http://auctionbytes.com/cab/pages/surveys/payment_012006

| About the author: |

| Ina Steiner is Editor of AuctionBytes.com and author of "Turn eBay Data Into Dollars" (McGraw-Hill 2006). She has a background in marketing and research in the high-tech and publishing fields. If you have story ideas, comments or questions, send them to ina@auctionbytes.com. |

PayPal prepares for a challenge from Google - WSJ

Mr. Jordan, who is president of eBay Inc.'s PayPal online-payments unit, immediately asked employees to unearth information about the Google service. Soon, PayPal employees were monitoring blogs, news reports and other data for information about Google's progress in payments. PayPal staffers even gleaned details about Google's plans during regular calls to customers who were eager to dish about how Google had reached out to them.

"It's a very legitimate competitive threat," says Mr. Jordan, 47 years old. "It's hard not to pay attention to what Google is doing."

![[Jeff Jordan]](http://online.wsj.com/public/resources/images/HC-GH438_Jordan_20060203171229.gif)

While Google Chief Executive Eric Schmidt confirmed in press accounts that the company was building a payment service, Mr. Schmidt also denied it would directly compete with PayPal. Mr. Schmidt said Google didn't intend to offer a "person-to-person, stored-value payments system," which many people consider a description of PayPal's service.

Mr. Jordan says he and his team immediately "dissected the wording" of Google's statements. He says he doesn't believe Mr. Schmidt. In the past, Mr. Jordan says, Mr. Schmidt had denied Google would roll out a payments service, only to take it back later. "We took [the comments Mr. Schmidt made] as 'Thou doth protest too much,' " says Mr. Jordan.

Long the Internet's leading online-payments service, PayPal has a 24% market share of U.S. online payments, according to financial-institution consulting firm Celent LLC. PayPal, founded in 1998, boasts 96 million accounts with consumers who want to send payments online without revealing their credit-card or banking information to vendors. To use the service, customers simply set up an account with their credit-card or bank-account details, fill out a payment amount and the email address of the recipient, and send the payment via the Internet to PayPal. If the recipient doesn't have an account, he simply opens one in order to collect the payment. The service gained traction on eBay and proved to be more popular than an in-house payment system it had been using.

For eBay, which acquired the online-payment business in October 2002, PayPal has been a big asset. The unit has helped accelerate trading on eBay's auction sites in the U.S., Germany and the United Kingdom. Most recently, PayPal generated 23% of eBay's total $1.3 billion quarterly revenue. And PayPal's revenue is growing steadily: It was up 48% to $304.4 million in the fourth quarter compared with a year earlier.

But PayPal must now contend with Google. The Mountain View, Calif., Web-search giant, which has terrified Silicon Valley with its ability to quickly create new consumer products and services, is developing a rival service called GBuy. For the last nine months, Google has recruited online retailers to test GBuy, according to one person briefed on the service. GBuy will feature an icon posted alongside the paid-search ads of merchants, which Google hopes will tempt consumers to click on the ads, says this person. GBuy will also let consumers store their credit-card information on Google.

Google said that it has acknowledged publicly on many occasions that it is working on payment products. The company also said it already processes online payments for ad services, as well as fees from consumers who use features such as Google Store and Google Earth. It declined to comment on any pending products.

The Google challenge comes amid PayPal's push to win new business. In June, the San Jose, Calif., business introduced new software and tools so smaller merchants could process PayPal transactions on their own Web sites. Its sales force has been recruiting big-name merchants such as Dell Inc. and Sharper Image Corp. to accept PayPal as an option on their Web stores. Late last year, PayPal purchased VeriSign Inc.'s online-payments-technology unit for $370 million to help build ties to hundreds of new merchants.

Throughout this effort, Mr. Jordan -- who is often mentioned by colleagues and recruiters as a possible successor to eBay Chief Executive Meg Whitman -- has led the charge. A graduate of Amherst College and Stanford University's business school, he spent eight years at Walt Disney Co. At Disney, where he once worked with Ms. Whitman, he managed strategic planning for the consumer-products division and was chief financial officer for Disney Store Worldwide. Ms. Whitman recruited him to join eBay in 1999. He was appointed PayPal president in late 2004.

An avid mountain biker, Mr. Jordan begins his workday at around 5 a.m. at the eBay gym, perched atop a stationary bicycle while tapping away on his BlackBerry. If he makes it home by 7 p.m. in time to have dinner with his kids, he considers himself lucky. People who know Mr. Jordan say he is extremely competitive and detail-oriented -- so much so that he monitors message boards to gauge customer complaints, often firing off messages to employees asking for fixes.

Mr. Jordan has been marshalling his forces for a possible battle with Google. He and his team have run through competitive scenarios to assess the risks PayPal might face with a Google service, an exercise the company also runs through with other rivals.

Mr. Jordan also accelerated the development of some products to stretch PayPal's lead in online payments and increased product-development spending by as much as fourfold in some areas. Though he declined to go into details, the company is working on tools to attract new merchants to use PayPal as an option on their Web stores. These new tools will be released later this year.

Attracting new merchants is important for PayPal because it needs to expand beyond its core eBay users to keep generating more revenue. Sixty-nine percent of PayPal's fourth-quarter revenue came from eBay-related transactions. Last year, PayPal developed software that lets merchants accept payments by phone, fax or mail order and to process those through PayPal. It also helped speed the payment process so shipping and billing information is sent from PayPal to the merchant more quickly.

It has been challenging for PayPal to sign up many new online retailers, however. Sucharita Mulpuru, an analyst at Forrester Research, says some retailers are leery of associating themselves with a brand that is so closely intertwined with eBay's online-flea-market roots. In part because of that heritage, PayPal "doesn't feel like a sophisticated financial system like a Visa or MasterCard" to many retailers, says Ms. Mulpuru.

PayPal executives acknowledge they need to broaden the appeal of their service. Stephanie Tilenius, a PayPal vice president, says the company's sales force is working hard to show merchants how it can help lower their payment expenses and capitalize on its Internet-savvy consumer audience.

Still, some of PayPal's recent moves have paid off. The company generated $8.1 billion in payment volume through its system in the fourth quarter, up 45% from a year earlier. It produced $2.5 billion in payment volume in the fourth quarter, a 56% increase from a year earlier, from its merchant-services program. PayPal declined to disclose how many new merchants it has added to its service.

One new merchant PayPal recently signed up was White Mountain Insurance Group Ltd.'s Esurance Inc., an online auto insurer based in San Francisco. Before it had PayPal, Esurance accepted payments through credit cards, debit cards and electronic checks. By integrating PayPal into its Web site, it expanded its payment choices, making it "more efficient" for consumers, says John Swigart, an Esurance managing director. "Now we don't have to deal with waiting for checks in the mail, getting checks lost or waiting for invoices."

PayPal isn't Esurance's least expensive payment option or its most popular, but it is growing, Mr. Swigart adds. PayPal is "signing up hundreds of thousands of consumers a week," he says. "As they find ways to raise awareness among their customer base that PayPal is a usable and effective option for customers to use to pay for things online, I think they'll find a lot of success."

Write to Mylene Mangalindan at mylene.mangalindan@wsj.com