While Japan is ahead of the rest of the world by three or four years, and some aspects of the experience in Japan are unique to Japan, other aspects can be adapted to the US and give marketers a step up on the competition, according to eMarketer's new report, "Mobile Payments in Japan."

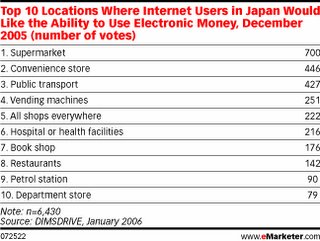

One survey revealed the top 10 locations where Internet users said they would like to use electronic money.

Another survey showed that 74% of Japanese consumers would like to use a mobile credit card in convenience stores, and 52% would like to use the device in a supermarket.

Consumers are attracted to the convenience of mobile payments because it not only removes the hassle of having to get cash, but it saves time. Consumers initially concentrate on paying for services where there is a low cost for trying it (like signing up for a card to save on a train ticket), or a low cost of failure (like only losing out on the cost of a cup of coffee). Convenience is the initial value point that gets people to try e-money and become curious about experimenting more, says the report.

"Almost every successful Japanese mobile data service has started out this way from ringtones to using a mobile device to operating a soda vending machine," write the report's authors, John du Pre Gauntt and James Belcher, senior analysts at eMarketer. "As customers grow in confidence and usage patterns, more sophisticated services are introduced for more money."

No comments:

Post a Comment